Yesterday I tweeted that, as I was walking my dogs in the evening as I am wont to do, I smelled a fire burning leaves. My first reaction to smelling it wasn't "hmm, somebody is getting rid of the clutter in their yard, kind of late in summer to be burning of last year's leaves but whatever." Instead my first thought ran to: "I wonder if that's against the law here."

Wow. I recoiled at the way my township's autocratic policies have become so commonplace to me that I stopped questioning their validity and instead jumped to enforce them. How could a libertarian, who believes in extreme levels of freedom, have ceded his own thoughts to the will of his extremely liberal local government? I have to say that I'm glad that I caught myself, but I fear how that line of thinking could have evolved if I hadn't.

Some background - I live in Takoma Park (the DC side) which is also known as "the People's Republic of Takoma Park" because it's political figures are so far to the left. Takoma has some very unusual laws, e.g. you cannot trim any trees whether or not it lies entirely on your property or not, the city is forbidden from purchasing any World Bank financial instruments (?!), and is officially considered a "Nuclear Free Zone".

Tuesday, August 31, 2010

Monday, August 30, 2010

Interesting Sentence

This one comes from Felix Salmon, in an article titled "Why Official Statistics are like Corporate Earnings":

"Statistics can be useful, but only if nobody much cares about them."I really enjoy this quote. I think its beauty lies in its simplicity. And how easily it cuts to the core of his position. I don't doubt that he is right in some respects, i.e. gerrymandering and perhaps some Bureau of Labor Statistics figures, but could he be right about other, more independent statistics-reporting firms? I'll have to think about that.

Thursday, August 26, 2010

Grammar

I find myself trying to construct sentences without a preposition at the end, but then they end up becoming less effective as a result. I do this all the time so it has become one of those hidden processes running in the background. That made this comic from Saturday Morning Breakfast, one of my favorites, especially funny:

Thursday, August 19, 2010

The Big Test

Taking the GMAT on Saturday. I've been studying for the last month - reading the books, doing the problem sets, and taking the practice exams. I'm very confident in my progress on learning this very important test, both its content and how to take it. But that doesn't stop me from having those dreams. Shoebox really got me today:

Tuesday, August 17, 2010

The History of World GDP

A few dominant observations from this chart:

A few dominant observations from this chart:- Italy, France, and Japan have had a consistent share of world GDP, although the Japanese industrial policy post-World War II was very successful by 1970. It has since tapered off.

- Look at how the US took off after 1820!! People talk about China's economic miracle, but they've always had a significant share. The US was just a blip until 1820, when our economic miracle began, topping out as a share of world GDP by the 1970s. This decline has more to do with growth in the emerging economies and the breakup of the former communist states than it does with a decline in the US's output.

- The Chinese have always been among the largest economies in the world. It's amazing what a dampening effect the revolution against the emporer through the takover of the communist regime had on GDP. And, conversely, the incredible growth that accompanied the loosening of the state's grip on the economy.

- Similar to the Chinese story, the fact that India has always had such a large share of world GDP. Also, the negative impact that the socialist (as opposed to communist) and bureaucratic ecoomic policy had on India post-independence in the 1940s.

Tuesday, August 10, 2010

Tales of ridiculous silliness in regulation

From an article at the NYT on a Merrill Lynch off balance sheet entity called Pryxis:

As a student, you are taught about the benefits of transparency but within an organization you are taught the benefits of opacity. In the real world, theory about what is good for outside investors goes out the door when your paycheck hinges on your capitulation to the party line.

Under these rules, a lawyer may not be able to prove that fraud existed, but any person who gives it a momentary thought can understand that this situation is ripe for exploitation. If all you need is someone willing to even entertain the notion that the bank is fully hedged, then you would never disclose your most material (and informational) positions!One difficulty for the S.E.C. and other investigators is determining exactly when banks should have disclosed more about their mortgage holdings. Banks are required to disclose only what they expect their exposure to be. If they believe they are fully hedged, they can even report that they have no exposure at all. Being wrong is no crime.

As a student, you are taught about the benefits of transparency but within an organization you are taught the benefits of opacity. In the real world, theory about what is good for outside investors goes out the door when your paycheck hinges on your capitulation to the party line.

Friday, August 6, 2010

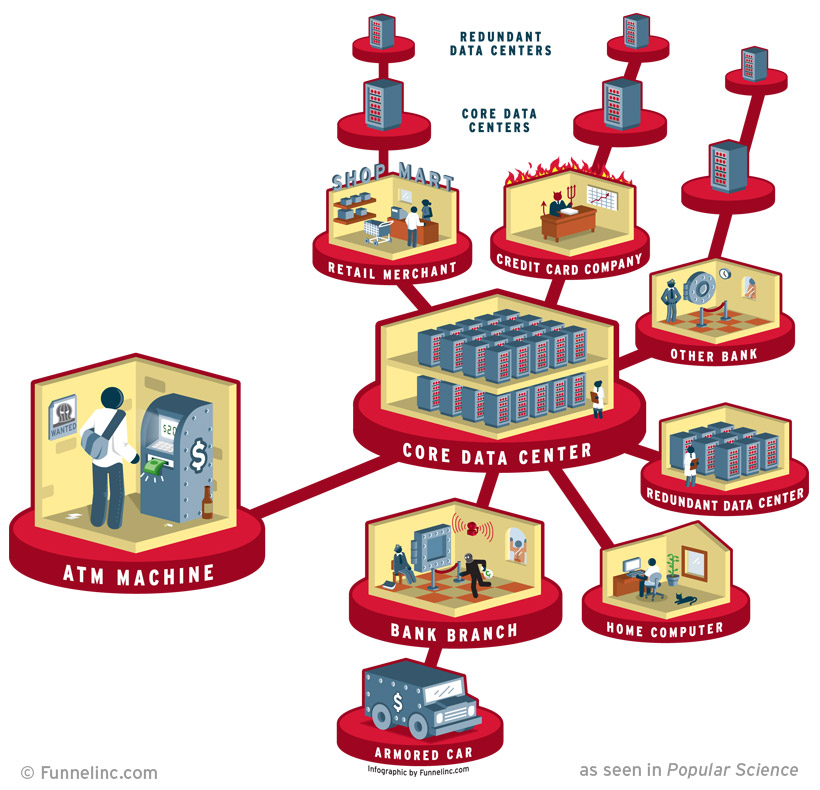

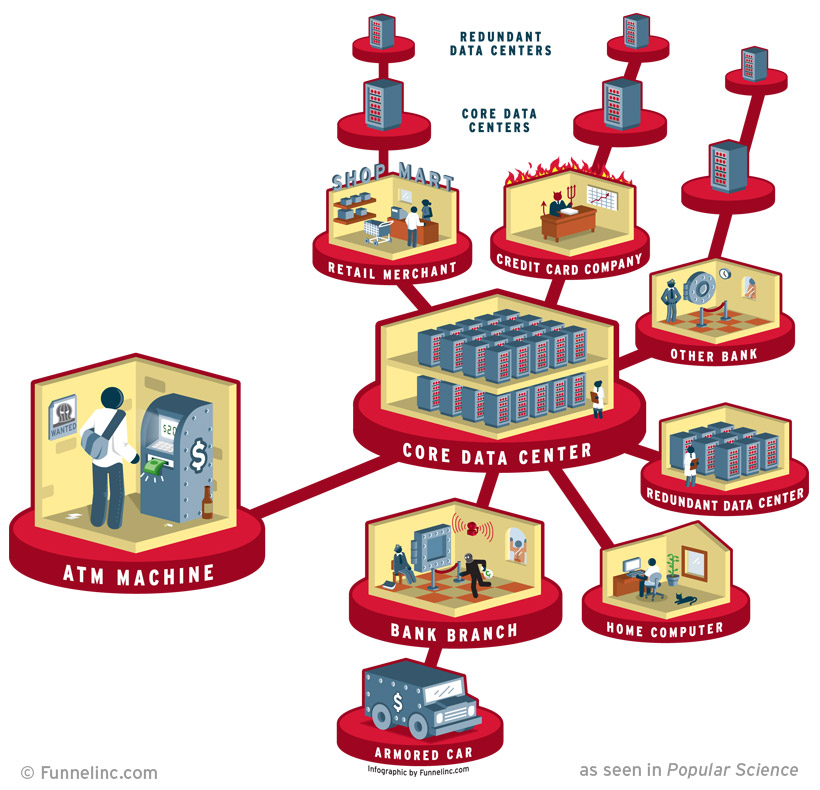

It's 10 o'clock, do you know where your money is?

This infographic is pretty cool. I don't often think about this type of thing, but it's important to know. Not in an I-can-change-it kind of way but more of a self-satisfying knowledge kind of way. Hat tip to Barry Ritholz.

Subscribe to:

Posts (Atom)